Serious about growth?

So are we.

So are we.

Built for advisors who demand more, Holistico is your full investment cycle co-pilot — helping you save time, win clients, and grow AUM.

Sign up for free

Everything you need to advise better — in one place

Streamlined workflows

Built by practicing advisors, Holistico eliminates manual work and tool-hopping. Analyze portfolios via file upload or integrations with Plaid, Orion, or Blueleaf — create proposals, rebalance, and monitor compliance across your book in one system.

Multi-factor insights

Our proprietary multi-factor scoring system helps you identify strong holdings through value, quality, and momentum lenses. It’s a structured, disciplined approach for those looking to move beyond passive strategies.

Integrated market intelligence

Access premium institutional-grade and macro data — including sector analytics and risk metrics — through licensed data partnerships. Everything is delivered in-platform, so you don’t need to pay for multiple data subscriptions.

At Holistico, we blend academic research and empirical expertise with AI intelligence to make investing seamless, strategic, and stress-free. From onboarding to rebalancing, Holistico keeps it simple, personalized, and proactive.

Sign up for free

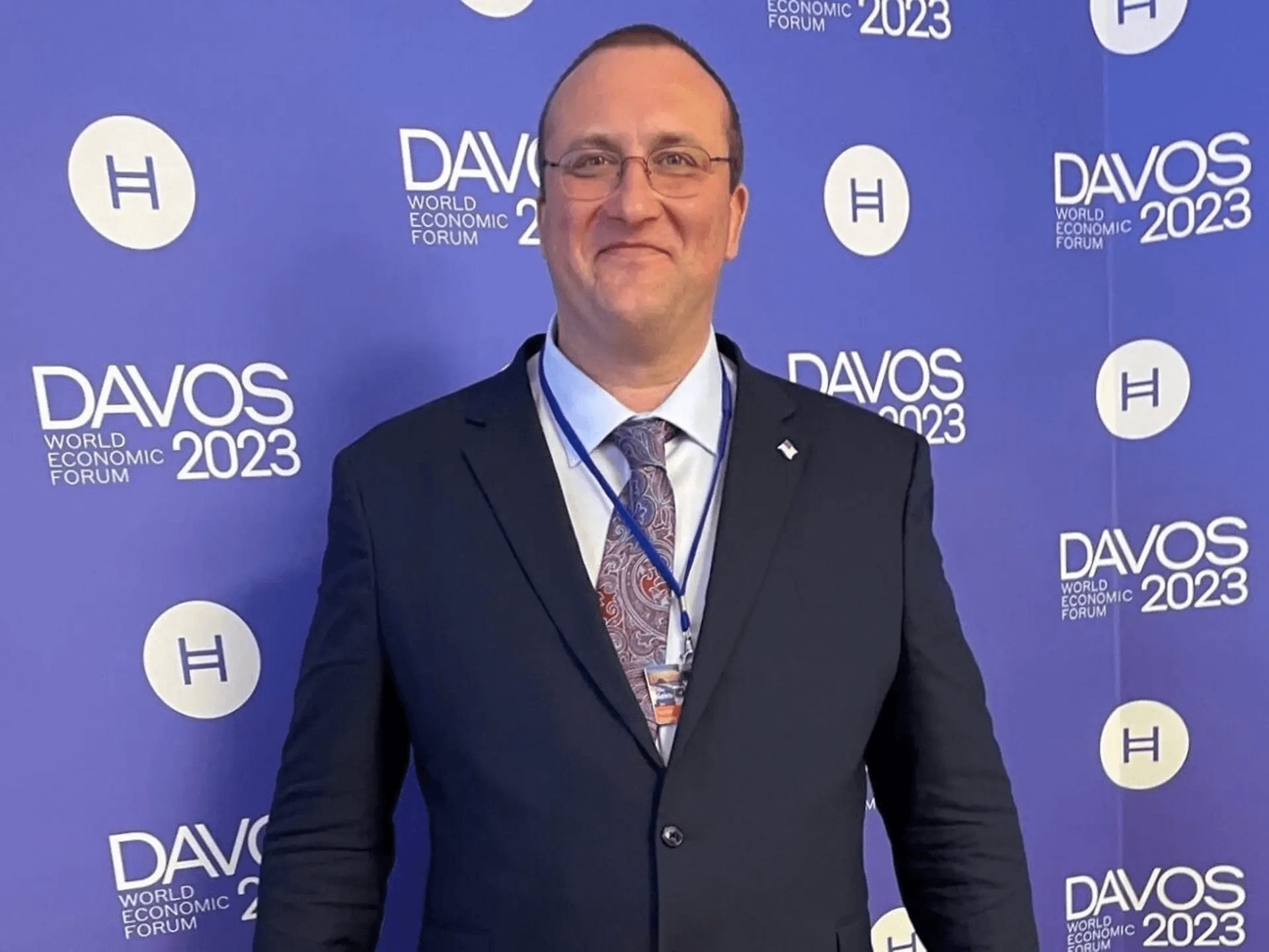

You’re in good company

We’ve worked with financial advisors and institutional investors to polish our toolkit, now available to you.

Welcome to our sphere of influence:

Welcome to our sphere of influence:

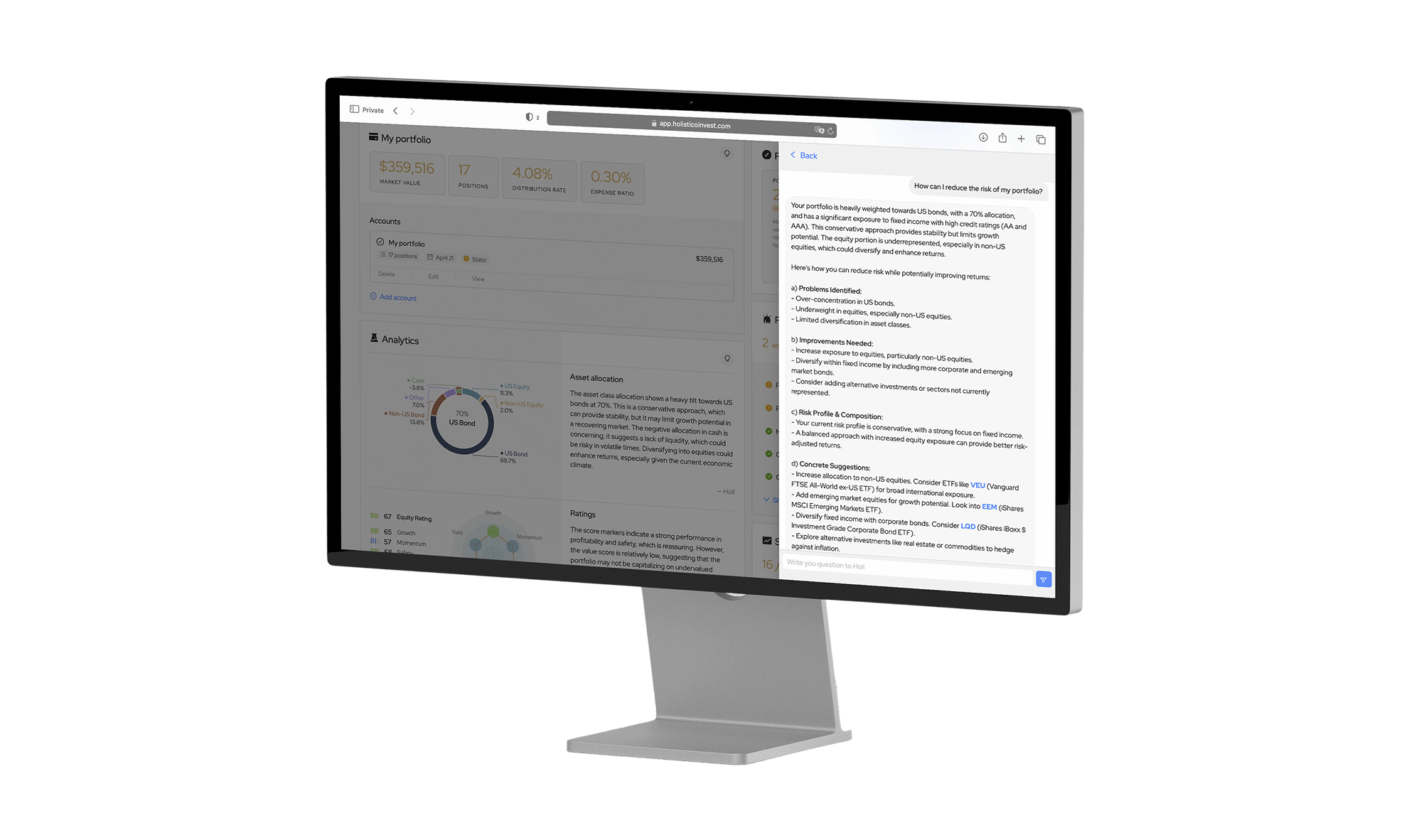

Meet Holi™

Your full investment cycle co-pilot

Holi™ is Holistico’s AI assistant — purpose-built for financial advisors. She understands your entire book of business and responds to voice or text commands, helping you move faster with fewer clicks.

Instant portfolio analysis

Generates structured insights based on market conditions and portfolio data.

Tailored investment suggestions

Provides data-backed recommendations for portfolio optimization.

Time-saving automation

Reduces manual research and enhances decision-making efficiency.

Voice-powered speed

Responds to voice commands — no filters, clicks, or queries required.

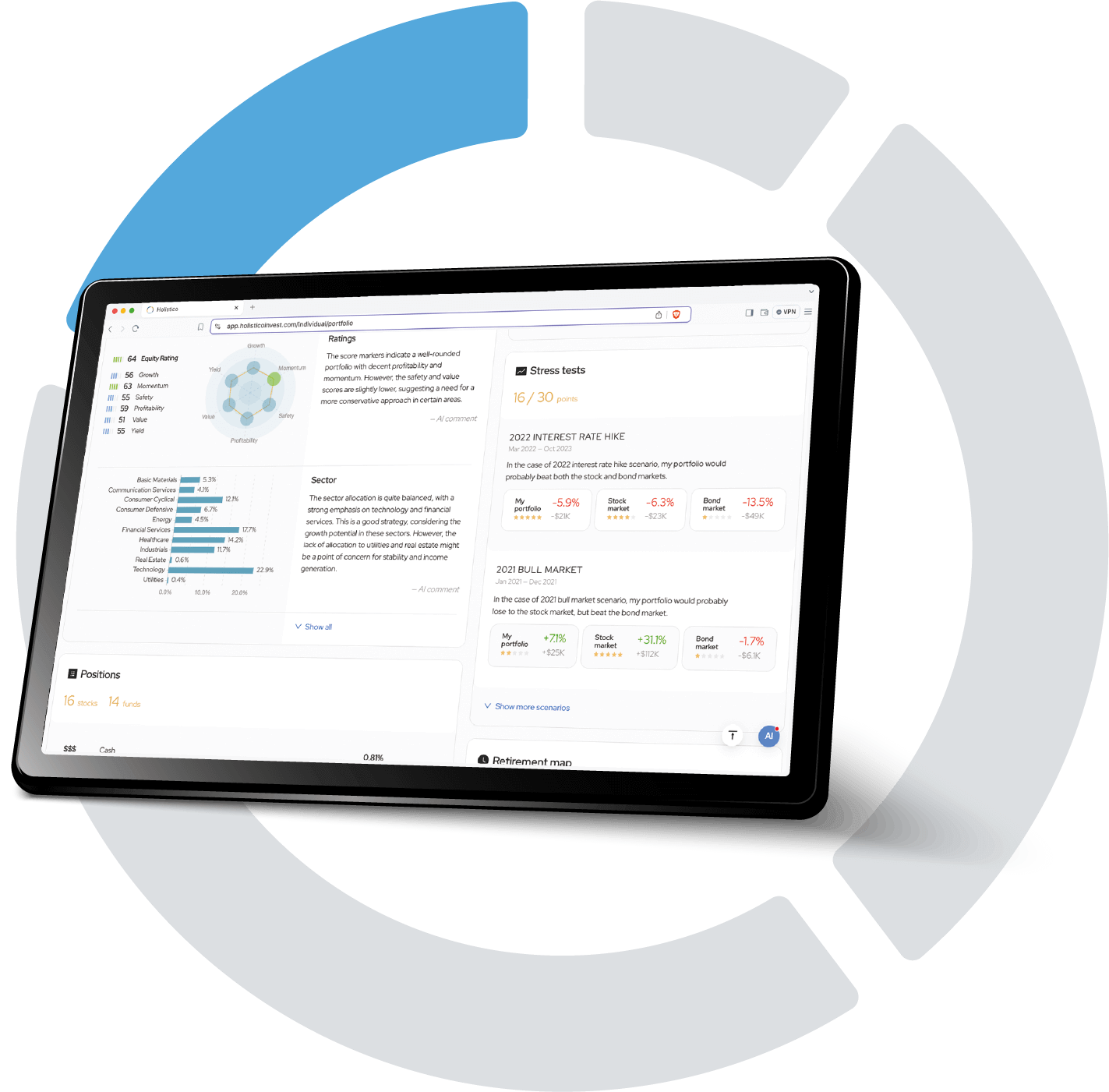

Explore your exclusive Holistico tools

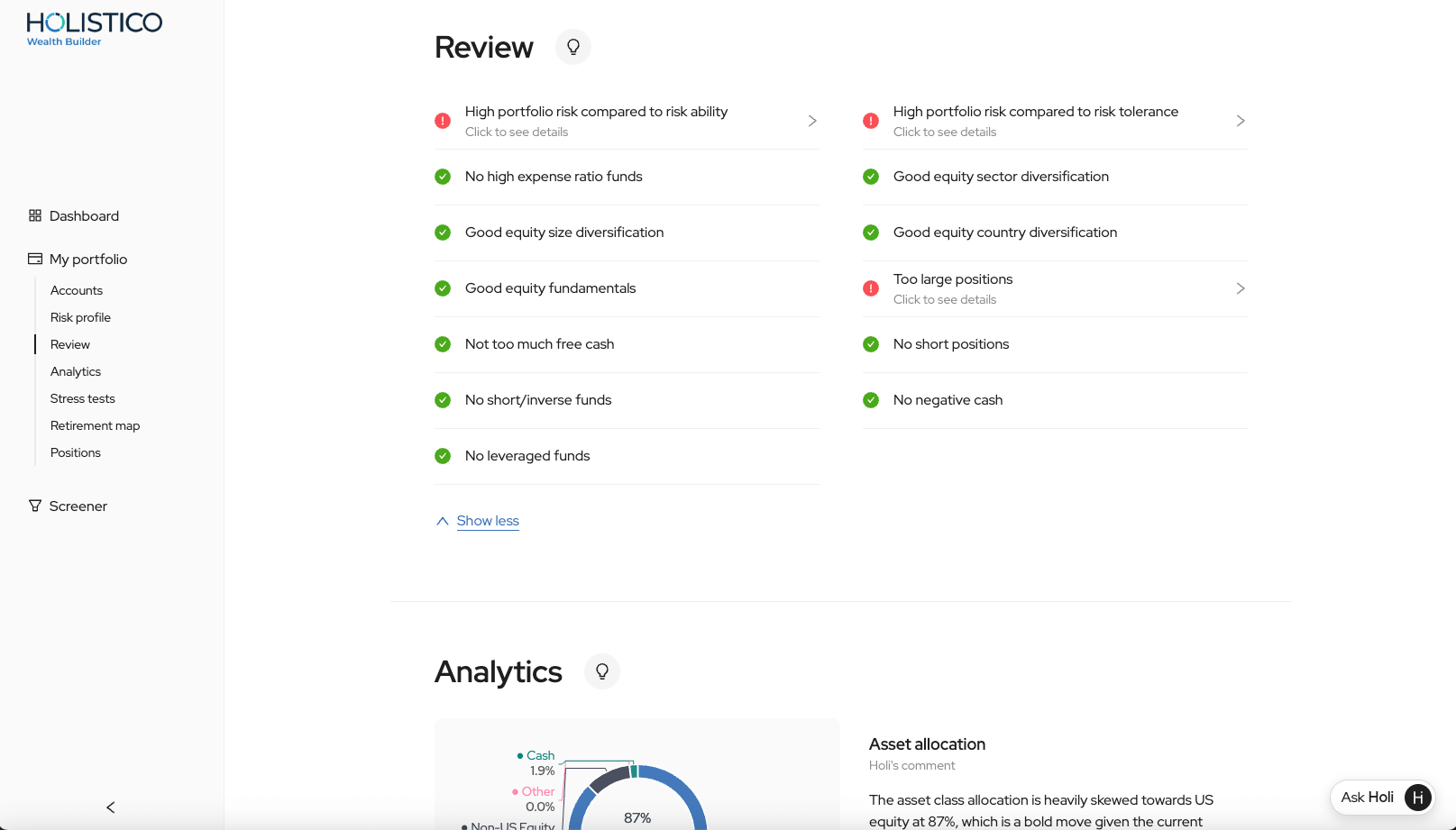

Portfolio Scanner™

Analyze portfolios in minutes to uncover opportunities and mitigate risks instantly.

Sign up for free

Click to expand gallery

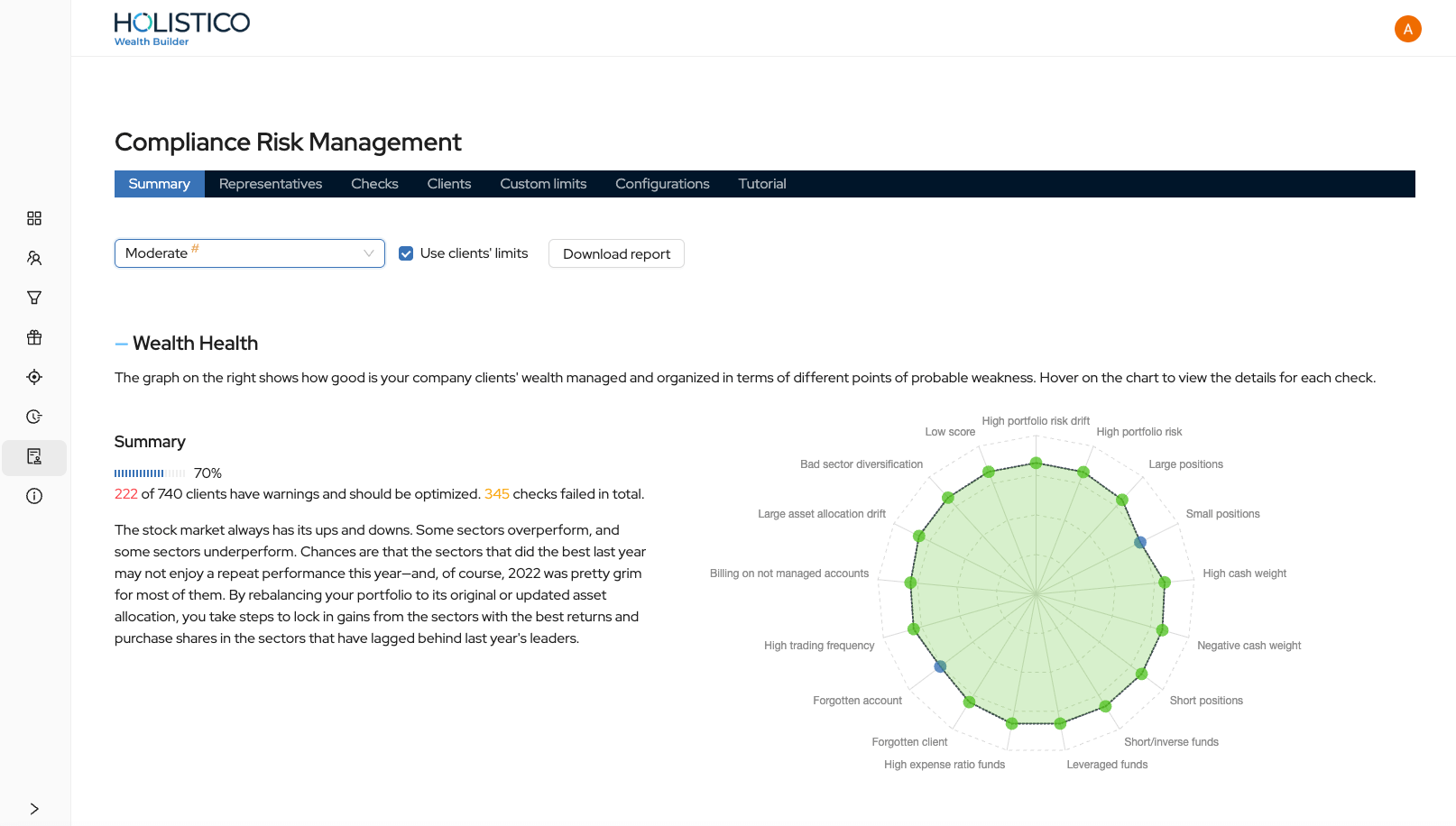

Compliance Risk Manager™

Proactively monitor portfolio risks and ensure regulatory compliance with actionable alerts and tailored recommendations.

Sign up for free

Click to expand gallery

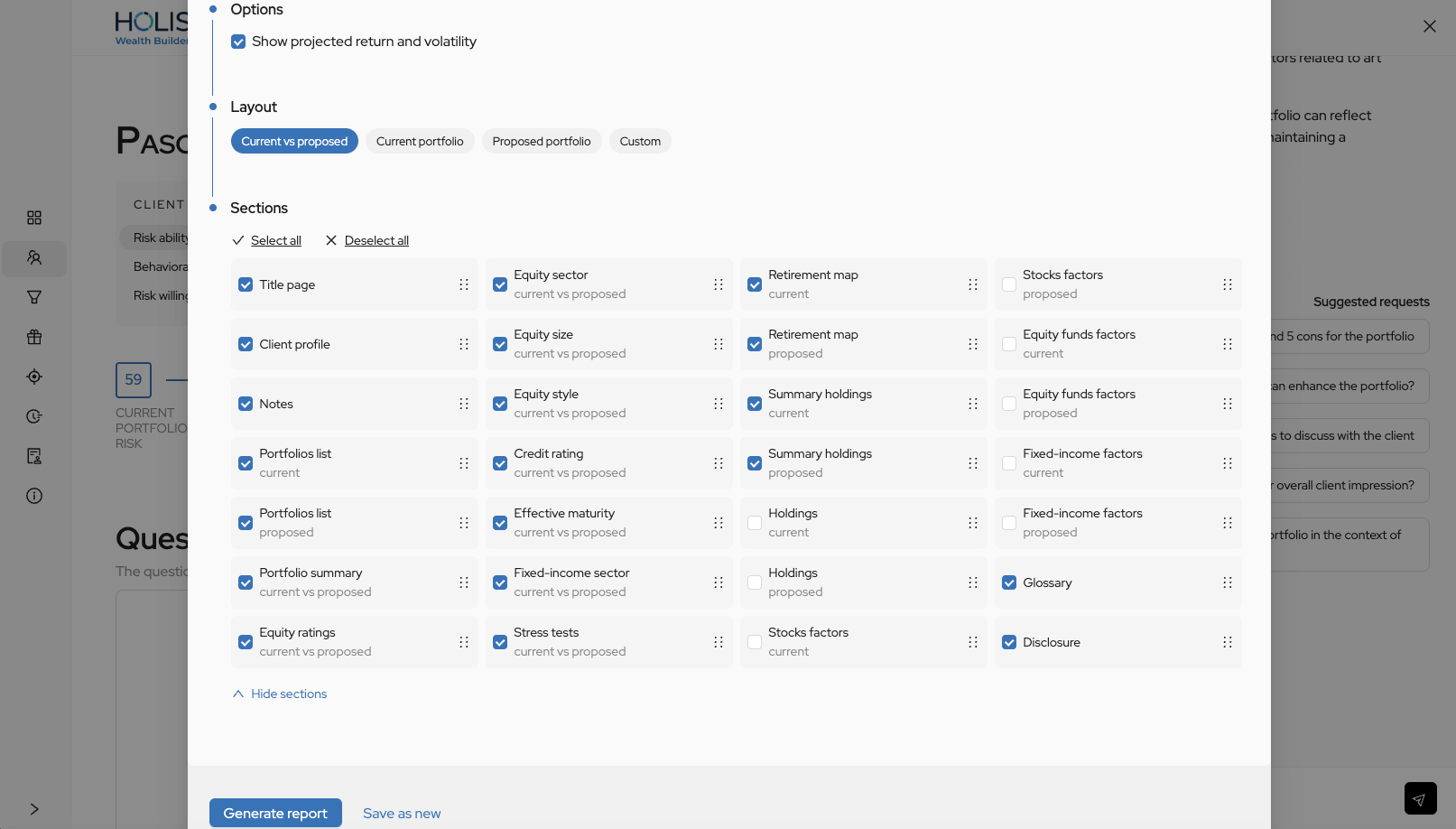

Proposal Builder™

Create polished, client-ready proposals with customizable templates and automated report generation. Deliver clear, professional insights that showcase portfolio strategies with confidence.

Sign up for free

Click to expand gallery

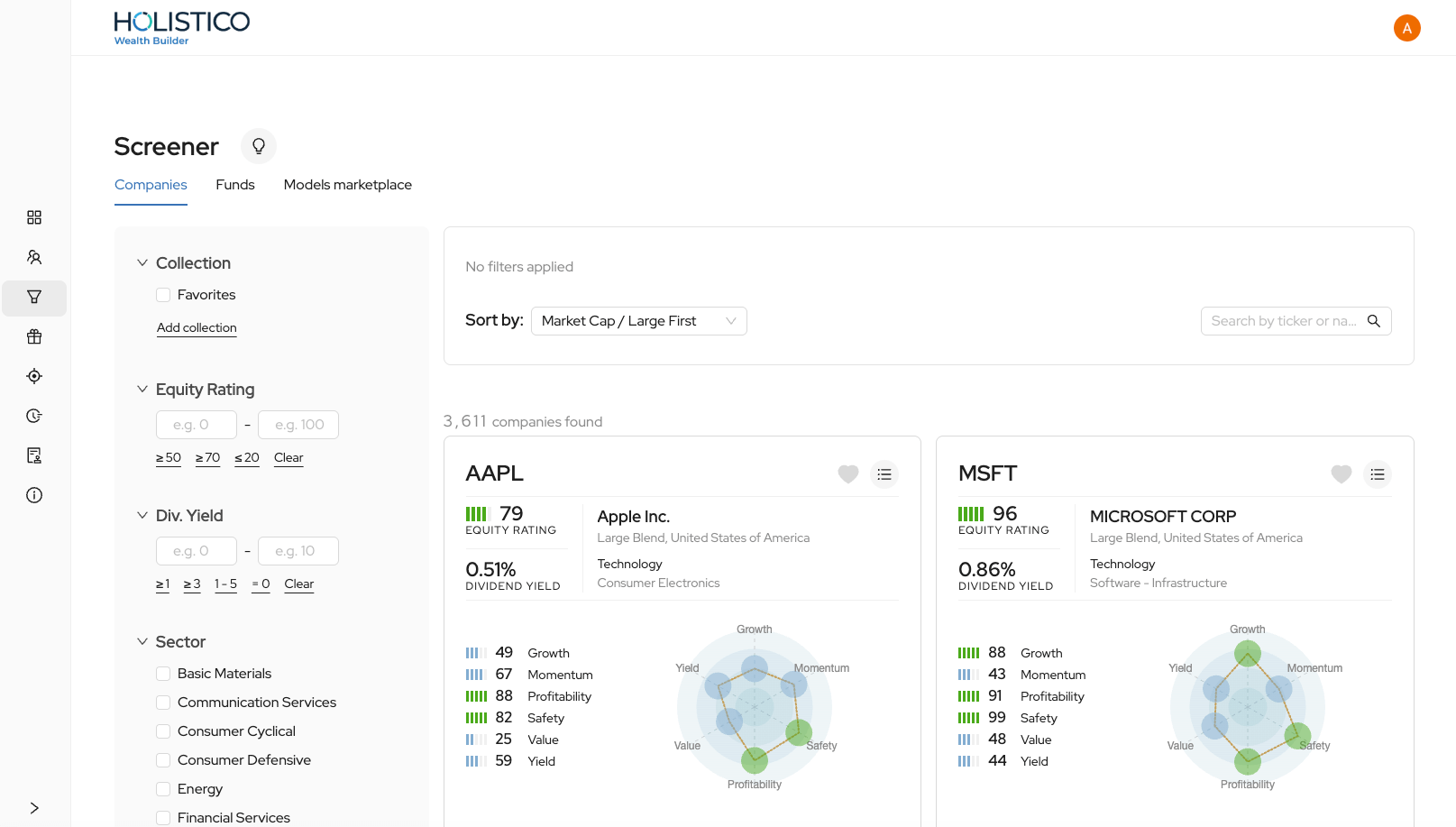

Asset Screener™

Quickly filter and analyze investment opportunities using metrics, such as ratings, sectors, and dividend yields. Leverage key metrics to identify top-performing funds and equities, ensuring informed and impactful recommendations.

Sign up for free

Click to expand gallery

Enterprise-grade security

Holistico runs on a secure, continuously monitored infrastructure built for modern advisory work. Data is encrypted in transit, protected by strict access controls, and supported by robust security protocols. Every module — from portfolio uploads to compliance monitoring — operates within this verified control environment, ensuring that your workflows and your clients’ data stay protected.

View security controls

See Holistico in action

Watch demos and real-world workflows

Real clients. Real results.

This platform is the tool that finally gives me what I’ve always wanted for my investment experience — all in a single solution. It quickly collects and evaluates data from me regarding my investment personality, risk tolerance, and strategy.

Cedric Knight

CEO – New Directions Technologies Inc

Being a busy CPA, I spend my time serving my clients and not often have time to look after my own needs. When I tried Holistico, I was happy to discover how easy it is to use the product, it took very little time to upload my current portfolio for analysis, and fine tune my profile.

Alec Ronin

Managing Partner – Brontide LLC

Great tool for portfolio analysis! Love the automatic account sync and AI chat features. The risk assessment survey is spot-on, and it's super helpful to check investment ideas against my strategy. Overall, solid service that does what it promises without unnecessary complexity.

Alex Falcon

Software Engineering Manager

The best part about Holistico is being able to chat with AI about my portfolio. It already knows what I own and suggests what I might be missing. It's super convenient to check ticker data and compare recommended stocks right in the chat.

Sergei Sorokin

Head of 3D – Replika

In the news

Explore recent product updates, interviews, and event recaps

Discover answers to your common questions

What makes Holistico different?

Holistico is built by advisors, for advisors. Its modular design, AI-powered insights, and focus on compliance make it an essential toolkit for modern wealth management and advisory practices.

How does Holistico improve efficiency?

Holistico automates time-consuming tasks such as portfolio analysis, compliance risk checks, and report generation, allowing you to focus on delivering value to your clients.

Is Holistico suitable for smaller firms?

Absolutely. Holistico’s modular architecture makes it scalable for firms of any size, empowering smaller firms to compete with larger institutions using cutting-edge tools.

How does Holistico help with compliance?

Holistico’s Compliance Risk Manager™ tracks and flags portfolio risks, providing clear recommendations to address potential issues and ensure regulatory readiness.

How is Holistico’s AI assistant Holi™ different from other modern AI tools?

Holi™ was purpose-built for the way financial professionals think and work — not just to generate content or summarize trends.

She’s grounded in multi-factor investment frameworks like Value, Momentum, Quality, and Safety, drawing on academically validated research from Graham, Buffett, Fabozzi, and O’Shaughnessy. Her models are trained on over 20 years of real portfolio strategies and allocation decisions made within a working RIA — not on scraped financial content. What sets Holi™ apart is how she combines traditional investment logic with AI capabilities — without letting AI dominate scoring or forecasting. Advisors stay in control, while Holi™ brings clarity, flags risks like style drift or overexposure, and suggests adjustments that align with your philosophy and your client’s goals.

Holi™ fits seamlessly into the full investment cycle — from research and proposal generation to ongoing portfolio monitoring and strategy refinement — helping you stay compliant, scale your practice, and deliver more informed, personalized advice.

You can ask Holi™ questions like:

She’s grounded in multi-factor investment frameworks like Value, Momentum, Quality, and Safety, drawing on academically validated research from Graham, Buffett, Fabozzi, and O’Shaughnessy. Her models are trained on over 20 years of real portfolio strategies and allocation decisions made within a working RIA — not on scraped financial content. What sets Holi™ apart is how she combines traditional investment logic with AI capabilities — without letting AI dominate scoring or forecasting. Advisors stay in control, while Holi™ brings clarity, flags risks like style drift or overexposure, and suggests adjustments that align with your philosophy and your client’s goals.

Holi™ fits seamlessly into the full investment cycle — from research and proposal generation to ongoing portfolio monitoring and strategy refinement — helping you stay compliant, scale your practice, and deliver more informed, personalized advice.

You can ask Holi™ questions like:

- Which clients are taking on too much risk relative to their age?

- What’s the best way to invest extra cash for better returns with low risk?

- Which holdings add the most risk, and how should I reduce them?

Can I customize how I use Holistico?

Yes, Holistico’s modular design in wealth innovation lets you choose the tools that fit your practice and scale as needed, ensuring a flexible and tailored experience.